On July 18, 2024, more than 400 students from the Faculty of Finance and Commerce, Marketing, and E-Commerce at Hutech University participated in the seminar “Innovation and Application of Fintech & Blockchain Technology in the Digital Economy,” with the attendance of experts from the Vietnam Blockchain Association and the Academy of Blockchain and AI Innovation.

Mr. Trần Dinh, Chair of the Fintech Applications Committee at the Vietnam Blockchain Association (VBA), opened the seminar at Hutech with an overview presentation on the development trends, legal policies impacting the Fintech environment, and real-world examples of successful business models. This provided students with valuable knowledge and insights into the Fintech sector.

According to Mr. Trần Dinh, Vietnam is one of the most promising untapped fintech markets, thanks to its high internet usage rate, with nearly 80% of the population using the internet and over 78 million smartphone users as of early 2024. Additionally, more than 50% of Vietnam’s population is under 35, a dynamic group that readily embraces new technologies. Furthermore, the COVID-19 pandemic has accelerated digital transformation and significantly shifted the payment habits of a portion of the population towards online methods.

However, the actual development of the Fintech sector in Vietnam has not yet matched its potential. The size of Vietnam’s Fintech market is relatively modest, estimated to reach over $16 billion in 2024, with only 263 Fintech companies operating in various sectors such as payments, lending, insurance, and asset management. This includes 51 non-bank organizations licensed by the State Bank of Vietnam to act as payment intermediaries and 16 financial companies (as of March 2024). These numbers are far behind neighboring countries like Singapore with 1,580 companies, Malaysia with 612, and Thailand with 293 companies.

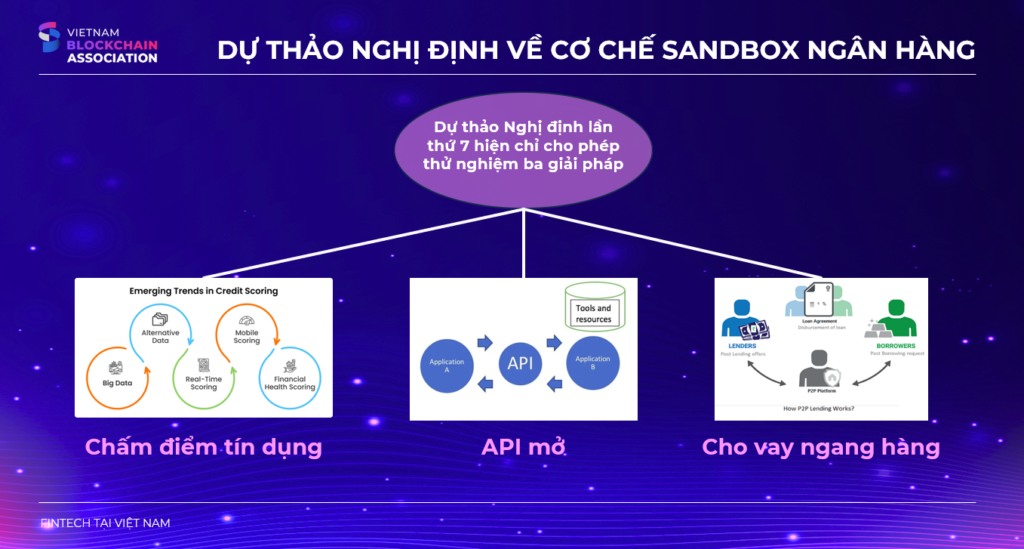

To promote the fintech industry, the State Bank of Vietnam initiated a draft decree on the Regulatory Sandbox Mechanism for the banking sector in 2021. However, after seven drafts, by March 2024, only three solutions were allowed for testing in the Sandbox Decree for Fintech: (1) credit scoring; (2) data sharing through open application programming interfaces (Open API); and (3) peer-to-peer lending (P2P Lending). The maximum testing period is two years.

“I believe this draft is of great significance, serving as a foundation to drive the development of Vietnam’s fintech sector in the coming years,” Mr. Trần Dinh emphasized.

Following Mr. Trần Dinh’s presentation, speaker Nguyễn Hoàng Minh, a representative from FireGroup Technology, shared insights on the development of Fintech technology, innovations in financial and banking services, challenges, and solutions. Mr. Nguyễn Cao Tấn Khải, a representative from Chainlink Vietnam, discussed the elements of the connected economy, providing a comprehensive view of system integration, improving efficiency and information security, and opening up new opportunities for the development and application of Fintech & Blockchain technologies in the digital economy.

Within the framework of the seminar, faculty members and students from Hutech participated in a discussion session on the topic “The Future of Fintech & Blockchain in the Digital Economy,” with the participation of Mr. Hàng Minh Lợi (Director of the AI Innovation Center – AIIC, under the ABAII Institute), Ms. Lê Vũ Hương Quỳnh (representing Tether), and Mr. Nguyễn Cao Tấn Khải (representing Chainlink Vietnam). The experts discussed the current status, development trends, challenges, and opportunities of Fintech and Blockchain in Vietnam and globally; the challenges and opportunities of applying Fintech and Blockchain in the digital economy; and how businesses and organizations can collaborate to promote the development of Fintech and Blockchain, shaping the future of the Fintech industry.

According to Ms. Lê Vũ Hương Quỳnh, “Vietnam has a great opportunity to become a leading fintech and blockchain hub in Southeast Asia, thanks to its young, well-educated workforce and a strong willingness to embrace change. To achieve this, education and training must be heavily invested in to create a workforce ready to meet the demands of this rapidly growing industry.”

In addition to gaining specialized knowledge and skills, students from Hutech University also had the opportunity to connect with business experts, increasing their career prospects and encouraging participation in startup projects involving Fintech & Blockchain.