With a comprehensive legal framework, blockchain applications are expected to make significant contributions to the national economy. This untapped financial flow is projected to surpass even annual foreign direct investment (FDI) inflows.

“This is the first time the Vietnam Blockchain Association (VBA) has presented a comprehensive overview of the blockchain industry from an application perspective, openly addressing challenges instead of focusing solely on technology as in previous years,” emphasized Mr. Phan Đức Trung, Executive Vice Chairman of the Vietnam Blockchain Association, during the 2nd Anniversary Celebration held in April.

The event was attended by Deputy Minister of Science and Technology Nguyễn Hoàng Giang, Deputy Chairman of the National Assembly’s Committee on Foreign Affairs Nguyễn Mạnh Tiến, and representatives from various government agencies, enterprises, virtual asset service providers (VASPs), media, and over 1,500 in-person participants.

Specifically, five key trends in blockchain technology applications currently receiving significant investment and development include Bitcoin and Spot Bitcoin ETFs, Real-World Asset (RWA) tokenization, Decentralized Finance (DeFi), Metaverse integrated with AI, and advancing the global VA-VASP legal framework.

To provide individuals and organizations with a comprehensive perspective on the blockchain industry and trends in its technological applications, the Vietnam Blockchain Association presents the full speech of Executive Vice Chairman Phan Đức Trung as follows:

Bitcoin and Spot Bitcoin ETFs

Bitcoin, considered the foundational element of the virtual assets (VA) market, has reached a significant milestone with the U.S. Securities and Exchange Commission (SEC) approving the Spot Bitcoin ETF. This event is regarded as a pivotal moment, marking a new stage in the development of this asset class.

On January 10, 2024, the SEC approved the Spot Bitcoin ETF and authorized trading for 11 investment funds. These include renowned funds such as BlackRock, with total assets under management of $10.5 trillion, as well as smaller players like Fidelity and Franklin Templeton, and emerging funds such as Grayscale.

Through Spot Bitcoin ETFs, nearly $10 billion flows into the U.S. stock market daily. Cumulatively, over three months from January 10, 2024, to April 24, 2024, total Spot Bitcoin ETF transactions reached $230 billion.

Notably, as of February 29, 2024, less than two months after approval, the total value of Spot Bitcoin ETFs in the U.S. had reached $43.2 billion. This is over half of the $92.3 billion total value of gold ETFs, which have been established for nearly 20 years since their official launch in November 2004.

The market appears to believe that Spot Bitcoin ETFs will continue to grow and eagerly anticipates the day when Spot Bitcoin ETFs surpass gold in total transaction value.

Another factor driving Bitcoin’s growth expectations is the Fourth Bitcoin Halving on April 20, 2024, marking a critical milestone. At this point, the block rewards for miners were halved, reducing the supply of Bitcoin and making it increasingly scarce in the future.

It’s important to note that the gold market can still experience inflation if the assumption about the abundance of gold on Earth is correct, or if initiatives like Elon Musk’s Mars exploration program uncover new gold reserves. However, Bitcoin’s supply has been pre-programmed to end by 2140, capped at a total of 21 million coins.

From a purely technological perspective, Bitcoin may not seem particularly remarkable. However, what stands out is its ability to balance the interests of participants in a decentralized transaction network, where diminishing mining rewards simultaneously incentivize enhanced security. In upcoming conferences, we aim to bring the largest clean Bitcoin providers to Vietnam, providing the community with more opportunities to understand that Bitcoin’s nature is entirely transparent. The miners, in essence, are the participants actively safeguarding the network’s security.

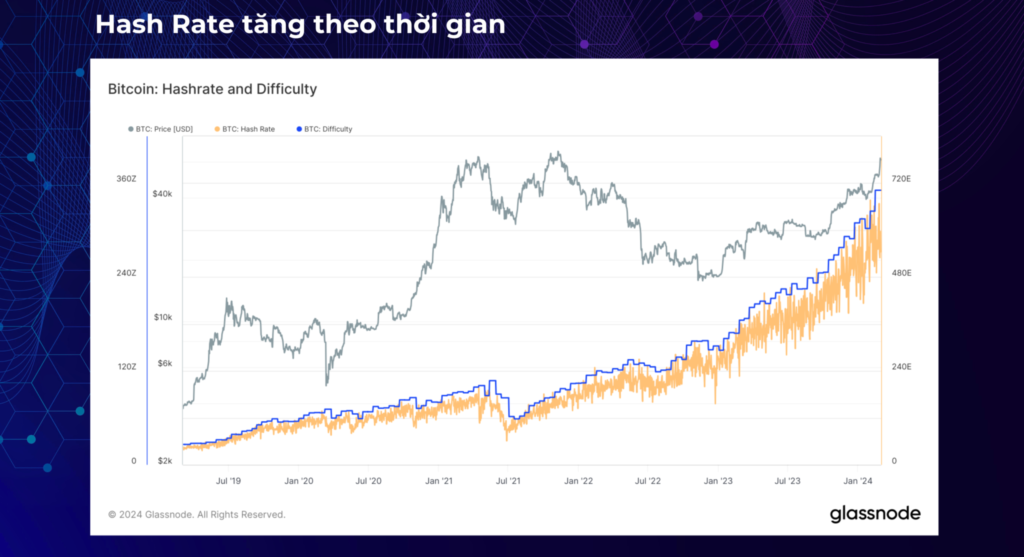

Due to the effects of deflation, increasing mining difficulty, and enhanced network security, Bitcoin’s price has consistently risen during each Halving cycle.

Real-World Asset (RWA) Tokenization

The second trend, Real-World Asset (RWA) tokenization, enables assets of all kinds to be traded seamlessly on a cross-border network. This trend began with stablecoins, led by Tether, which operates with a team of only 50 people yet has introduced approximately $40 billion into the market. Currently, the market has expanded to include other assets such as government bonds and commodities.

According to a forecast by global consultancy firm BCG, tokenized RWAs will account for 10% of global GDP by 2030, reaching a value of $16 trillion—20 times higher than the current level of 0.3%–0.6% of global GDP. This is an imposing figure.

Now imagine a scenario where RWA becomes an inevitability, yet Vietnam lacks a regulatory framework to manage it. Will we be able to embrace this 10% share of GDP, or will it exist within the shadow economy in the form of tokens?

It’s important to clarify that RWA is not a fleeting trend; it has existed for a long time in various forms. The current narrative of asset tokenization is akin to discussions about stocks in the year 2000. It’s simply an expansion—moving from listing company values on stock exchanges to listing a broader range of assets on the blockchain network.

Decentralized Finance (DeFi) Trend

The third trend, decentralized finance (DeFi), is a concept that has been widely discussed. However, the notable development now is that the decentralized nature of DeFi is beginning to extend to other sectors, such as decentralized physical infrastructure (DePIN), decentralized social networks (deSocial), and DeScience, which supports scientists.

Metaverse Combined with AI Trend

The resurgence of the metaverse, combined with AI, has redefined the concept of the metaverse that we’ve been familiar with for years. This trend can be highlighted by the revival of Facebook’s stock. Over the past year, Facebook investors have seen remarkable success, with the company’s stock value doubling in one year and nearly tripling over two years. This success reflects Facebook’s steadfast commitment to the virtual world, where players only need to put on VR glasses to access a new experience.

Leading the virtual world market is The Sandbox, valued at approximately $1.4 billion. This company has also started to establish a presence in the Vietnamese market in early 2024.

Advancement of the Global VA-VASP Legal Framework

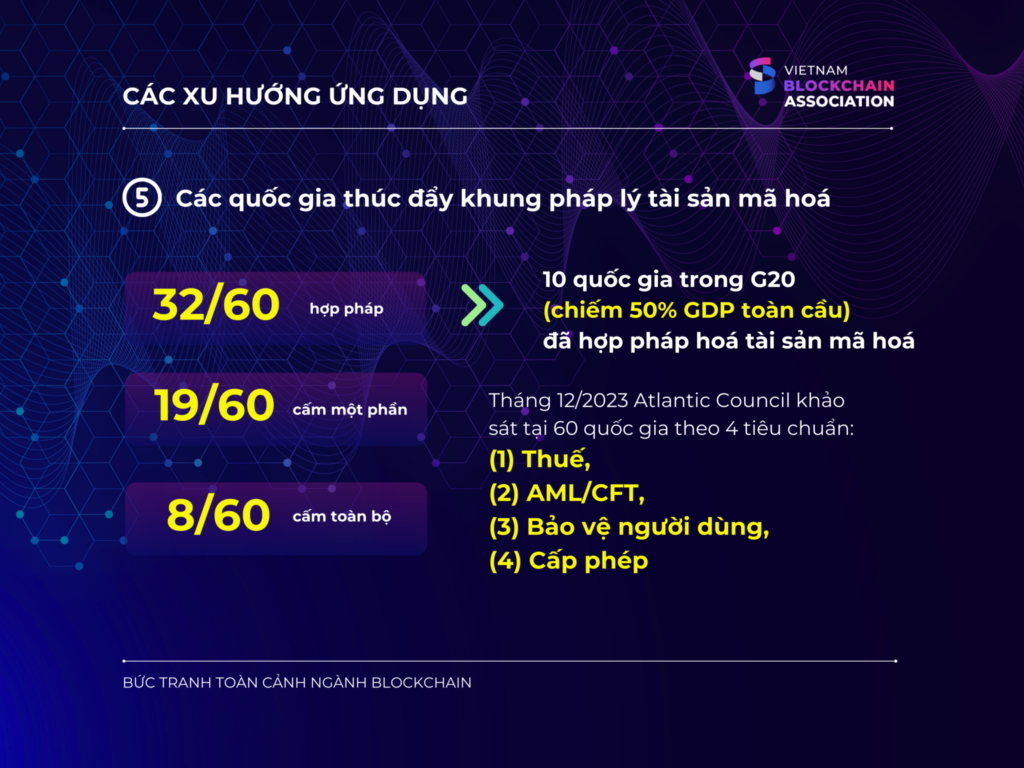

According to the latest research by the Atlantic Council (AC) across 60 countries, as of December 2023, 32 out of 60 nations have legalized virtual assets, including 10 G20 countries, accounting for 50% of global GDP. The study also indicates that 19 countries have implemented partial bans, while only 8 have imposed total prohibitions.

In another AC report, global GDP is a focal point. The study reveals that among 134 countries (representing 98% of global GDP) exploring Central Bank Digital Currencies (CBDCs), 68 nations (over 50%) have entered the development phase. Vietnam is among the countries currently researching this matter.

Blockchain Applications in Vietnam

According to research by the Atlantic Council (AC), countries are evaluated on their legal frameworks using four criteria: Taxation; Anti-Money Laundering and Counter-Terrorist Financing (AML/CTF); Consumer Protection; and Licensing.

Both Vietnam and China were found to meet none of these four criteria, according to the AC study. However, China’s legal framework must be considered under entirely different aspects due to geopolitical factors.

In practice, China does not ban crypto assets but instead manages them differently across various special economic zones to leverage regional advantages. On the mainland, China has developed a state-run Blockchain Service Network (BSN) to manage all domestic assets. Meanwhile, global virtual assets operate in Hong Kong, where the region is being positioned as a priority development zone with a comprehensive and open regulatory framework. This approach has been viewed as a valuable lesson for other nations.

In Cambodia, although a comprehensive legal framework is not yet in place, regulations for licensing VASPs to operate legally have already been established.

In Vietnam, 18 legal documents have been issued between 2017 and 2024, including those related to startups, and the upcoming National Blockchain Strategy is expected to be released as early as Q2 2024. I am optimistic that once promulgated, the National Blockchain Strategy will complement Decision No. 194/QĐ-TTg dated February 23, 2024, by the Prime Minister, which outlines the National Action Plan to remove Vietnam from the Financial Action Task Force (FATF) gray list.

According to the International Monetary Fund (IMF), countries placed on the gray list face a risk of losing approximately 7.8% of their GDP. Therefore, removing Vietnam from the gray list before 2025 is a critically urgent task.

As part of this action plan, the Government has proposed 17 commitments to the Financial Action Task Force (FATF), with Action 6 requiring Vietnam to establish a legal framework to either ban or regulate VA and VASP by May 2025.

I believe this demonstrates a strong determination by the Government, as it not only commits to issuing a legal framework to ban or regulate VASP but also pledges to demonstrate its enforcement capabilities. Through discussions with various regulatory authorities, most agree that issuing regulations is straightforward, but proving enforcement to international organizations is far more challenging.

Decision No. 194 also outlines Action 7 and Action 8, which call for the active participation and education of the private sector on blockchain and virtual assets. I believe that if the National Blockchain Strategy is approved by the Prime Minister, it will significantly support the implementation of Decision No. 194.

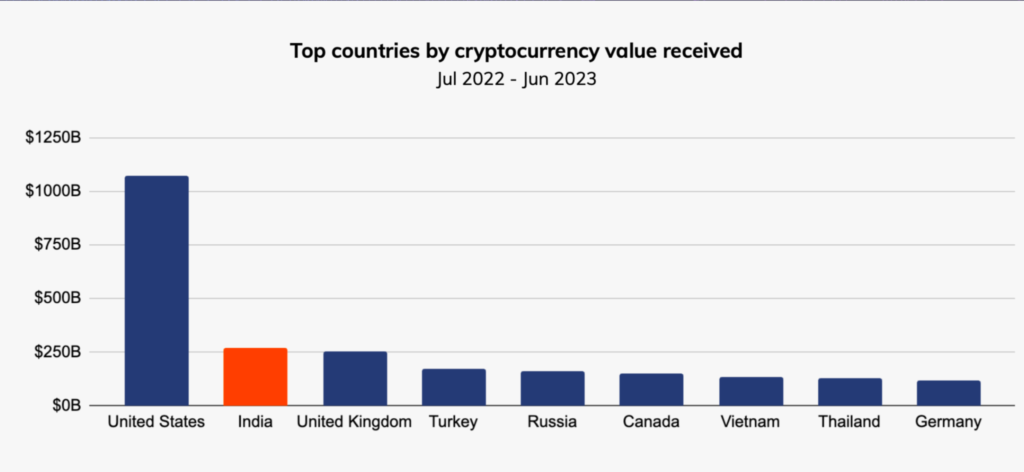

According to Chainalysis, from July 2022 to July 2023, $120 billion flowed into Vietnam through cryptocurrency assets, nearly five times the $25 billion total foreign direct investment (FDI). This figure even surpasses Thailand, where the shadow economy accounts for 40% of the country’s GDP.

Notably, almost all VASPs facilitating these transactions in Vietnam are centralized exchanges. These exchanges are unlicensed in Vietnam but offer Vietnamese-language interfaces for local users.

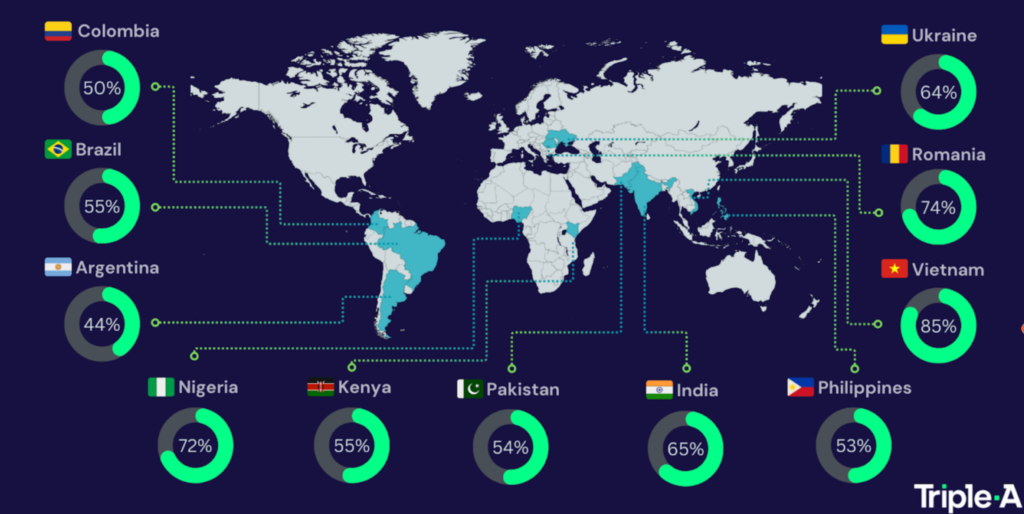

Another striking statistic, according to Triple A, is that 20% of Vietnam’s population, equivalent to 20 million people, own virtual assets, ranking third globally in terms of ownership numbers—trailing only the United States with 48 million owners and India, with its population exceeding one billion, at 93 million owners.

Among private sector participants and freelancers, approximately 85% own cryptocurrency assets, and 35% of them accept cryptocurrency as a form of payment. For example, TikTok content creators often receive payment for advertising contracts from foreign partners, such as those in the Philippines, in cryptocurrency when they are unable to receive payments via bank accounts.

In 2023, Vietnamese cryptocurrency speculators earned $1.168 billion, ranking third globally in cryptocurrency income. The top two countries are the United States with $9.6 billion and the United Kingdom with $1.3 billion.

Based on this data, we do not claim that cryptocurrency speculation is a sound investment activity. Instead, we aim to emphasize that this activity is being recorded, published, and partially acknowledged internationally.

Meanwhile, in Vietnam, as Deputy Minister Nguyễn Hoàng Giang of the Ministry of Science and Technology has shared, the Government provides significant support to enterprises in developing technologies. However, the application and effectiveness of these initiatives remain a complex issue that requires thorough analysis and resolution.

According to the Vietnam Blockchain Association (VBA), through two major seminars on Anti-Money Laundering (AML) in cryptocurrency transactions held at the State Bank of Vietnam in collaboration with the Vietnam Banks Association, commercial banks have indicated interest in researching or experimenting with blockchain-based payment systems. However, these initiatives have been halted due to excessive costs.

In practice, blockchain applications have not yielded significant benefits for financial institutions in Vietnam. This is because these banks primarily operate domestically without extending their influence regionally or globally, limiting the cross-border potential of blockchain technology.

In other industries, blockchain applications are being implemented in traditional use cases within small enterprises or in areas where the cost does not match the value, such as low-value agricultural traceability. The reality shows that Vietnam lacks large-scale enterprises to effectively adopt this technology.

Returning to the topic of policies on managing VA and VASP, from a positive perspective, early and appropriate implementation of these policies could transition the value of VA-VASP from the shadow economy into the formal economy. This would help protect consumers, support tax policies, combat money laundering, and counter- terrorism financing.

Moreover, suitable VA-VASP policies could address the capital challenges faced by businesses. As we observe difficulties in traditional capital-raising channels such as securities, banks, and bonds, it’s evident that cryptocurrency inflows into Vietnam are five times higher than FDI inflows.

Therefore, I hope that a year from now, we will not just discuss the shadow economy or Bitcoin price fluctuations. Instead, we will talk about how much capital VA-VASP has contributed to the economy.

Finally, I want to express my optimism, support, and high expectations for the strong determination and global vision of government agencies reflected in innovative and comprehensive decisions like the Prime Minister’s Decision No. 194 or the forthcoming National Blockchain Strategy. I firmly believe these initiatives will serve as a foundation and an opportunity for more dynamic discussions in the future, enabling Vietnam to open its doors to stronger economic contributions.