“Tokenization of real-world assets (RWA) opens new doors for integrating the superior advantages of blockchain technology into traditional assets, which are often constrained by national borders and transaction times,” shared Mr. Trần Huyền Dinh, Chairman of the Fintech Application Committee, Vietnam Blockchain Association, at the Workshop on Human Resource Development and Fintech Training on September 27, 2024.

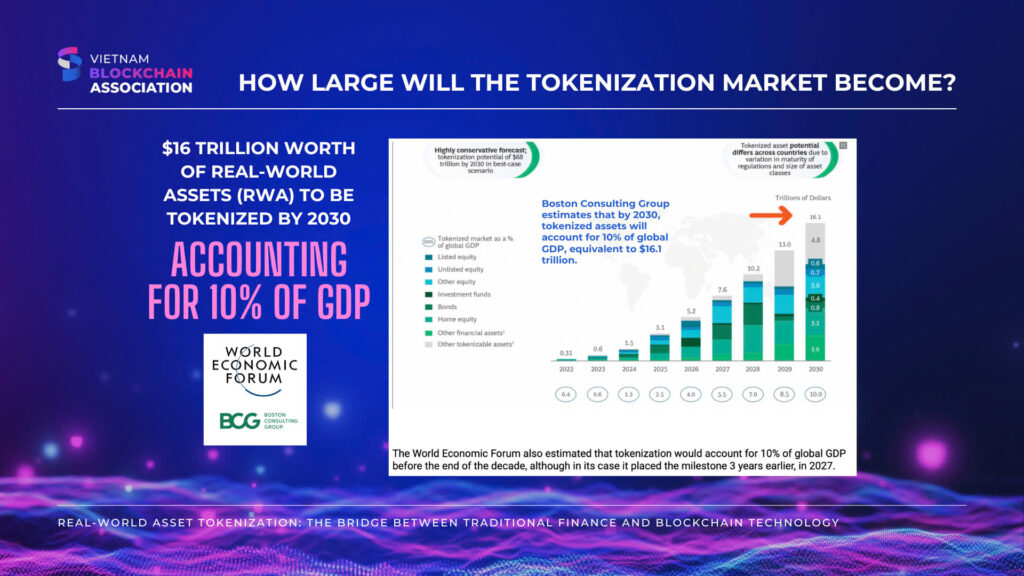

According to estimates from Boston Consulting Group, by 2030, the total value of tokenized real-world assets (RWA) could account for up to 10% of global GDP, equivalent to $16 trillion. Even more optimistically, a forecast from Standard Chartered Bank envisions the tokenized asset market reaching $30 trillion by 2034.

On September 27, 2024, Mr. Trần Huyền Dinh, Chairman of the Fintech Application Committee of the Vietnam Blockchain Association, attended and presented at the “Workshop on Human Resource Development and Fintech Training” organized by the Vietnam-Korea University of Information and Communication Technology – University of Danang. At the workshop, Mr. Dinh emphasized the important role of real-world asset tokenization (RWA), a revolutionary trend in bridging traditional finance with blockchain technology.

RWA is digitizing tangible assets such as real estate, commodities, art, or precious metals, and integrating them into the blockchain ecosystem. This increases liquidity, enables global trading, and enhances transparency. With the potential that RWA brings, the future of Vietnam’s Fintech sector heavily depends on embracing this technology, thereby driving digital transformation in the financial sector and elevating Vietnam’s position on the global financial map.

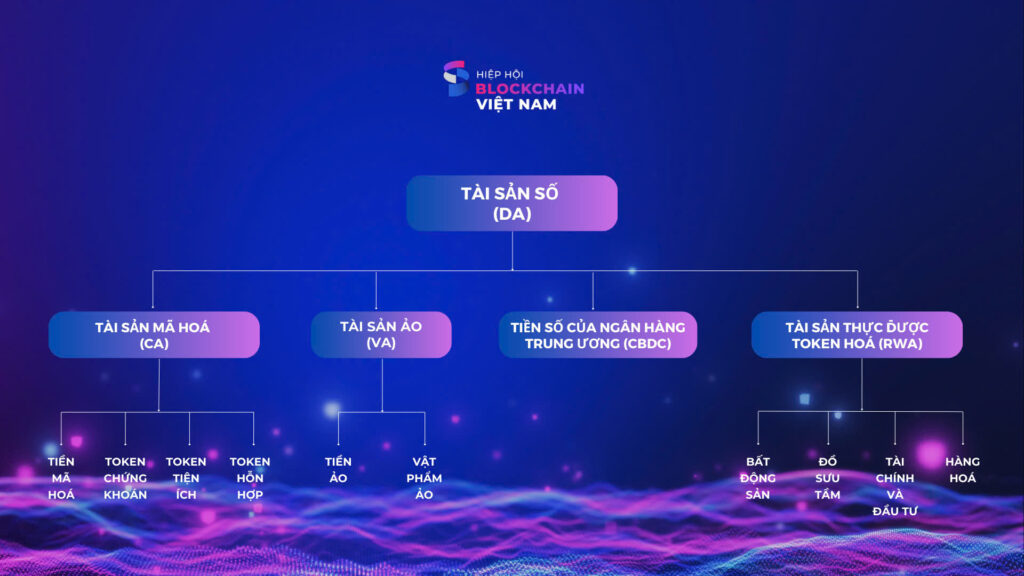

According to the latest definitions of digital assets, RWA is one of the four components that make up digital assets in general, along with three other types: Crypto assets, Virtual assets, and Central Bank Digital Currency (CBDC).

In this context, while crypto assets and virtual assets may not be backed by real-world assets, and CBDCs are exclusively issued by central banks, RWAs present several key advantages: They are backed by real-world assets, combined with the fast, cross-border transaction capabilities of blockchain technology, and can be issued by various financial institutions, offering greater flexibility and diversity.

Additionally, RWAs enhance asset transparency, increase global liquidity, lower transaction costs, and enable investors to easily diversify their portfolios.

Specifically, the nature of RWAs involves real-world assets (such as real estate, commodities, artworks, etc.) with proven value being tokenized and placed on the blockchain, ensuring their value and providing investors with confidence when choosing this asset class.

The rapid transaction speed, nearly instant, without limitations on time or trading location, is a significant advantage of RWAs. This allows individuals and financial institutions to engage in immediate, cross-border transactions, rather than waiting for the current T+2 settlement regulations. Expanding the trading scope globally also enhances the liquidity of existing assets, freeing them from the constraints of national borders or operating time zones.

Regarding the diversity of issuing institutions, RWAs are now trusted, tested, and issued by several major financial institutions. For example, the European Investment Bank has issued tokenized bonds on platforms provided by HSBC, Goldman Sachs, and others. JPMorgan announced that in 2023, its Onyx platform facilitated over $300 billion in intraday repo transactions.

Many studies indicate that the tokenization market will continue to grow strongly, potentially reaching trillions of dollars. However, for RWAs to develop in Vietnam, appropriate policy adjustments are necessary. The lack of a legal framework regarding ownership, issuance, and trading of tokenized assets poses a significant challenge, leading investors to be concerned about legal risks.

At the workshop, Mr. Dinh also shared information about the MasterTeck platform, developed by the ABAII Institute of Blockchain and Artificial Intelligence. This is Vietnam’s leading online education platform in Blockchain and AI, offering more than 300 diverse courses, focusing on 24 “hot” professions with high-income potential.

MasterTeck has a high-quality faculty of over 120 leading experts from and outside Vietnam. Renowned international certifications such as CompTIA, EC-Council, and PECB are issued in traditional and NFT formats, providing global transparency and direct integration with each student’s LinkedIn profile.

The “Human Resource Development and Fintech Training Workshop” organized by the Vietnam-Korea University of Information and Communication Technology – University of Danang attracted the participation of many organizations and industry experts. The event featured representatives from the Da Nang City Government, the fintech giant Hanwha Group from South Korea, professors from La Trobe University (Australia), and representatives from the Vietnam Blockchain Association. The workshop provided new solutions and directions for developing the Fintech sector in Vietnam.